The Great Laundering Mortgages

Churning the Dirty Money with Predatory Foreclosures

The BANKSTERS have been protected for Years as Campaign Contributors

The Trump Mafia with Obammy, Clintons, Bushs and Bidens let all the BANKSTERS off the Hook with CFPB, FBI, DOJ AND US POSTAL, HUD AND FHA. THE FIX HAS ALWAYS BEEN IN.

40 Years BEFORE The Con of THE CON

Swecker did Everything He Could to BLAME the Borrowers

The BANKSTERS have been protected for Years as Campaign Contributors

Lots and Lots of Fake Business Records are the Trick to the Trillions being Laundered … The Giant Laundries THRIVE ON Fake Business Records … Huh Mafia Donald … Mobster Trump

MURDER INCORPORATED SCREWS THE WHOLE WORLD

They Censor, Shadow Ban, Deplatform and Control the Net, to hide the truth and protect the Guilty, limiting the FINANCIAL EXPOSURE … Judson Witham

Imagine how Scummy the Houston Hot Tubs are

Lets take a look at the Original Complaint

Loan Sharks, Mortgage Sharks, the Hocus Pocus is in the Sharks Repossessions and Foreclosures … Predatory Lending, Predatory Repossession and CHURN / REPEAT .

Lets get all the 12 Million + Secreted SARS opened up and see how the SHARKS do the Magic

Is there a heightened pleading requirement for …

The Fourth Circuit has held that “allegations of a fraudulent scheme, in the absence of an assertion that a specific false claim was presented to the government for payment” are insufficient to meet Rule 9(b)’s heightened pleading standard. Id. at 456. “Instead, the critical question is whether the defendant caused

https://rumble.com/v1vqrnm-sars-….-fincen-doj-fbi-fha-hud.html

The art of the Reality Scam the CON of the Financial Scheme see Former TX Penal Code 1137 h May 1931

https://laymanslaw.home.blog/2019/06/28/deutsche-bank-the-mortgages-and-the-laundry/

TIME TO OPEN ALL THE SARS

Maybe Judge Robert Leon Jordan and Gerald Cugno were getting BJ’s from the Banksters at Pedo Island

https://www.bbc.co.uk/news/business-63750504.amp

Millions Of SECRETED SARS must be provided to the PUBLIC under FOIA

A Standard FOIA Demand to the USA Inc. Release ALL the SARS

Trillions in Looted and Laundered Money and the USA Inc. DOJ, FHA, HUD, FinCen and the House Banking and House Financial Services Committee think somehow FOIA ( Civil Investigation Demands ) do not apply to the USA Inc.. Well We’ll see after the NEW Revelations by The Congressional Committee investigating the BIDENS seems to think the Millions of SARS are NOT allowed to be SECRETED from the American People.

Lets take a look at what Congressman Comer of Kentucky has to say.

Yup Millions and Millions of Hidden SARS available to the Public and the Congress Imagine That

The Current FOIA Demand to the USA Inc. and It’s Agents and Agencies

Lets take a Walk down Memory Lane Shall We, YES 84 Captures since 1999

325% Worse than TBW the Lee FARKAS Mafia ( Lee and Andrew FARKAS ) Gerald Cugno had 7,500 Agents and 1,150 Offices causing many Banks HUD FHA FANNIE AND FREDDY ….. Like Colonial Bank billions in losses . Nothing gets changed.

UPDATE … DEUTSCHE BANK sued by it’s own insiders for scheming scamming Frauds worth trillions MORE FRAUD AGAIN …. https://www.newsbreak.com/news/2829404387370/deutsche-bank-sued-for-150-million-in-new-york-by-exonerated-trader-who-alleges-coverup

Wall Street Journal wrote a couple pieces on more than 131 Seriously Conflicted Federal Judges sitting on Cases when They have Millions in investments with the DEFENDANTS. FinCen has some things to explain as well.

Wall Street Banksters own the Judges FERS ….. The Scammers are the Government Pension Funds of the FAKE ASS HELICOPTER MONEY. The ABA and BANKSTER JUDGES will never fix Their Crooked Ass SYSTEM

Stealing and Laundering Gazillions with RBMS and Foreclosures ….. And CHURN . Pulitzer Winning NYTs reporter Gretchen Morgenson states THEY BOUGHT The System. They damned sure Bought US Judge Robert Leon Jordan ED Tennessee.

Courts CORRUPT the the Core

Judges like Robert Leon Jordan protect Mafia Trash like Gerald Cugno and the Dirty Banksters. Trey Gowdy and Nelson & Mullins with Baker and Donnelson run COVER UP with Robert Leon Jordan of the WSJ 131

CUGNO DEFAULTED this is FACT

https://www.bing.com/search?q=jp+morgan+deutsche+mortgages+laundering

Yeah that GERALD CUGNO

https://duckduckgo.com/?q=subprime+money+laundering+site%3Awww.cch.com

THE COMPROMISED COURTS

http://ricorealtythelootedtrillions.blogspot.com/2016/?m=1

CAUSE AND EFFECT OF CORRUPTION

https://www.google.com/search?q=how+to+loot+and+launder+trillions

FERS Strikes AGAIN https://www.wsj.com/articles/fallout-from-judges-financial-conflicts-spreads-to-appeals-courts-11646155384

FERS tells ALL https://thehill.com/opinion/judiciary/595331-stock-conflicts-weaken-trust-in-the-judicial-branch-too/

The money is typically then either legitimately invested or exchanged for expensive assets such as financed property. The Involvement of Banks in Money Laundering Major financial institutions, such as banks, are frequently used for money laundering. All that is necessary is for the bank to be a little lax in its reporting procedures. The goal is parking the funds and then repossession and churn the assets again and again and again …….

So it seems Vanguard JUDGE Jordan’s big Investment Broker is in Money Laundering with PREDATORY Foreclosures with JP Morgan Chase Credit Suisse and Deutsche Bank and Gerald Cugno …. What a Mafia Racket https://www.google.com/search?q=mortgages+laundering+money

WOW US DISTRICT JUDGE ROBERT LEON JORDAN’S Major Investments in Vanguard, Credit Suisse, JP Morgan Chase and Deutsche Bank …. You are Hugely Conflicted Jordan …. Now You’re Exposed

https://laymanslaw.home.blog/laundering-the-loot…

Laundering the Loot The Great American Laundry

- Web results

Laundering the Loot The Great American Laundry – Law for …laymanslaw.home.blog › laundering-the-loot-the-great-… The GIANT Money Laundry of American Subprime Foreclosures PARKING THE LOOT In American … The Great American Manure Job | Trillions Stolen… How to Steal and L…

See more on laymanslaw.home.blog

- Estimated Reading Time: 9 mins

https://lootednation.wordpress.com/houston-tx-the…

HOUSTON TX ….. The Biggest Government Fraud EVER

WebThe Westgate Investments, Western Banks, RLG Gang has BILLIONS in Assets ALL OVER America and ALL OVER THE WORLD. Western Banks Swiss, British, Middle Eastern and …

https://laymanslaw.home.blog/land-swindles-bank…

Land Swindles Bank Lootings Money Laundering AMERICAN STYLE

WebThe Publicans, Bush Pioneer, Blair House NELDA and the Western Bank Westgate Investments, RLG and the CIA MAFIA of the Conoco Building 1300 Main Street Houston …

Steal TRILLIONS with Real Estate – Credit Default Swaps Subprime …

- home.bloghttps://laymanslaw.home.blog/laundering-the-loot…Laundering the Loot The Great American LaundryWebHow to Steal and Launder Trillions in American Foreclosures …laymanslaw.home.blog › how-to-steal-and-launder-trilli… The REAL ACCOUNTS of Looting and Laundering Trillions …

Good OL Boy

Judge Robert Leon Jordan

Some RACKET Your investment Partners are perpetrating

30 Trillion Notes WHAT A SCAM

https://www.google.com/search?q=30+trillion+debt&oq=30+Trillion

https://www.google.com/search?q=JP+Morgan+Chase++%22Deutsche%22+Bank+Fined

It would appear Looting and Laundering Trillions is part of the DARK WINTER CONSPIRACY. Comey, Mueller, Chris Wrey, Chris Swecker, Eric Holder, Eric Schneiderman even Joe Smith, National Global Mortgage Settlement Office Raleigh is involved …. https://rumble.com/vu5e9x-grand-jury-the-court-of-public-opinion-dr.-reiner-fuellmichs-opening-statem.html

MANY TRILLIONS LOOTED AND DARK WINTER …. Part of the COVER UP https://rumble.com/vu5e9x-grand-jury-the-court-of-public-opinion-dr.-reiner-fuellmichs-opening-statem.html

The Dirt Dealing Rackets on Steroids

https://www.bing.com/search?q=land+scheme+trillions+looted+subprime

THE ACTUAL FACTS OF REALTY SCAMMING AND FINANCIAL LOOTING

https://www.google.com/search?q=money+laundering+subprime+mortgages+foreclosures+judson+witham

Just as I’ve been saying since the 1980s https://www.google.com/search?q=trillions+looted+money+laundering

https://toxiczombiedevelopments.wordpress.com/cugno-the-racket/

https://www.bing.com/search?q=JP%20Morgan%20Deutsche%20Mortgages%20Laundering

THE PERFECT STORM … Loan Sharks, Repo Men, Judges, Regulators, Congress, Senate, State AGs CHURN, REPEAT …. The Vilest Viral Corruption

J. Witham

Parking money in High Risk SUBPRIME

Yup the very same Financial Scammers raking in trillions from the Viruses are the very same financial firms FAVORITE to Federal Judges

Typical Cover Ups

The mortgage scams, Foreclosure Scams and the Laundry https://duckduckgo.com/?q=deutsche+jp+morgan+money+laundry

THEY ALL HAVE THEIR HEADS ON THE SAME PILLOW

Dirt dealing , mortgage finance racketeering, and the money trails https://toxiczombiedevelopments.wordpress.com/mortgage-fraud-bank-looting-money-laundering-land-swindles-judson-witham/

Laundering the Trillions with PREDATORY MORTGAGES / FORECLOSURES …. Churn and REPEAT

https://www.thestreet.com/investing/jpmorgan-jpm-deutsche-bank-db-money-laundering-report

BREAKING NEWS

Blatant corruption …. hundreds of blatantly corrupted/conflicted Federal Judges see the Judicial Accountability Center and

https://www.bing.com/search?q=JP%20Morgan%20Deutsche%20Mortgages%20Laundering

Wall Street Journal

United States District Clerk

Eastern District of Tennessee

220 West Depot Street

Suite 200

Greeneville, Tennessee 37743

Jan 10th 2022

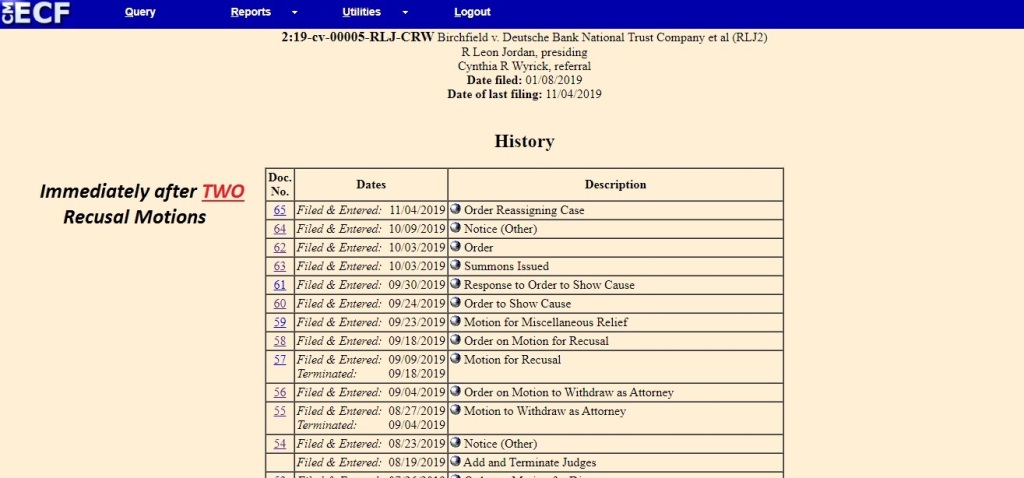

Judge Robert Leon Jordan, NOTICE OF CONFLICTS / RECUSAL ….. Credit Suisse, JP Morgan Chase, Vanguard, Deutsche Bank / Pensions and Mortgage Banks / Premier Mortgage Funding, Gerald Cugno Et Al

Motion for New Trial, Recusal and Entry of Default Judgements

Premier Mortgage and Gerald Cugno

Judge Clifton L. Corker / Robert Leon Jordan

Case 2:19-CV-005

SENIOR FEDERAL JUDGE EASTERN DISTRICT TENNESSEE AT GREENVILLE

Inbox

| SwampFox <notjuris@gmail.com> | 6:56 PM (29 minutes ago) |   | |

to FRC, contact, Info, Esq., john.baxter, tips, tips, tips, tips, trey.gowdy, bmonroe, Tips, Kim, Financial, FSCDems, Gerry, georgia, Cc:, Stephen, bcc: Jacqueline, bcc: Kim, bcc: Patrick |

The Wall Street Journal and Judicial Accountability Center outted many many Federal Judges sitting on cases while having investments directly and indirectly in Banksters like JP Morgan Chase, Deutsche Bank, AIG and Credit Suisse, VANGUARD and BLACK ROCK just to name a few. Judge Jordan’s Bank Stocks / Investments alone tied to Vanguard and Black Rock, AIG Etc Etc Et Al are BLATANT CONFLICTS.

It appears Judge Robert Leon Jordan is Directly an Investor in all the above and as such was severely conflicted in the Premier Mortgage, Gugno, Deutsche, Credit Suisse, JP Morgan Chase case involving the CUGNO MAFIA etc etal.

Please be NOTICED that Judge Jordan and all 6th Circuit Judges with fingerprints of investments in sitting on this matter are SERIOUSLY CONFLICTED and a NEW TRIAL will be needed. Judge Robert Leon Jordan’s Financial Investments in Vanguard , AIG, JP Morgan Chase and the Many Other Banks and Pension Funds pose a very serious CONFLICT OF INTERESTS.

The Premier / Cugno Defaults and Default Judgements should be entered.

Judge Jordan should have RECUSED HIMSELF rather that conceal these conflicts. The Collusion and Racketeering among the Defendants and the Networks of Investors and Owners …. enormously exposed Judge Robert Leon Jordan’s Investments to LARGE LOSSES.

Judicial Financial Disclosure Forms for Robert Leon Jordan …

https://www.courtlistener.com › person › 1680 › disclosure › 27537 › robert-leon-jordan Judicial Financial Disclosure Forms for Robert Leon Jordan (E.D. Tennessee) at the Judicial Financial Disclosures Database. https://fintel.io/so/us/cs

https://adirondackslakegeorgefreepress.wordpress.com/laundering-with-the-dirtiest-banksters/

FOLLOW THE MONEY

https://www.bing.com/search?q=Looting+America++Trillions++Stolen

Vanguard Group Inc ownership in AIG / American …

https://fintel.io › so › us › aig › vanguard-group2021-02-10 – Vanguard Group Inc has filed an SC 13G/A form with the Securities and Exchange Commission (SEC) disclosing ownership of 80,337,158 shares of American International Group Inc (US:AIG). This represents 9.32 percent ownership of the company.

BlackRock, Vanguard, State Street own the US

www.ronpaulforums.com › showthread.php?517340-BlackRock-Vanguard-State-Street-own-the-USVanguard Group, State Street, Fidelity. The 8 largest US financial companies – JPMorgan, Wells Fargo, Bank of America, Citigroup, Goldman Sachs, U.S. Bancorp, Bank of New York Mellon and Morgan Stanley – are 100% controlled by ten shareholders. The “big four” are major shareholders in all of these 8 financial institutions.

Conspiracy Theorists Ask ‘Who Owns the New York Fed?’ Here …

https://www.institutionalinvestor.com › article › b1kh4p10qysrhv › Conspiracy-Theorists-Ask-Who-Owns-the-New-York-Fed-Here-s-the-AnswerThe No. 2 holder stockholder was JPMorganChaseBank, with 60.6 million shares, equal to 29.5 percent of the total. … DeutscheBank Trust Co. Americas was the owner of 1.7 million shares, and …

Vanguard S&P 500 ETF (NYSEARCA:VOO) Shares Acquired by …

https://etfdailynews.com › news › vanguard-sp-500-etf-nysearcavoo-shares-acquired-by-manning-napier-group-llc CreditSuisse AG grew its position in Vanguard S&P 500 ETF by 105,380.1% during the second quarter. CreditSuisse AG now owns 2,119,096 shares of the company’s stock worth $833,906,000 after buying…

Deutsche Bank, JPMorgan, UBS charged with fraud – Vanguard …

https://www.vanguardngr.com › 2010 › 03 › deutsche-bank-jpmorgan-ubs-charged-with-fraud DeutscheBank, JPMorgan, UBS charged with fraud – Vanguard News DeutscheBank, JPMorgan, UBS charged with fraud DeutscheBank AG, JP MorganChase & Co., UBS AG and Hypo Real Estate Holding…

Vanguard Group Inc reports 3.04% increase in ownership of …

https://fintel.io › so › us › db › vanguard-group2021-11-12 – Vanguard Group Inc has filed a 13F-HR form disclosing ownership of 67,501,953 shares of DeutscheBank AG (US:DB) with total holdings valued at $857,274,000 USD as of 2021-09-30. Other investors with positions similar to Vanguard Group Inc include Capital Research Global Investors , and Hudson Executive Capital LP .

Deutsche Bank AG Has $23.91 Million Position in Vanguard …

https://www.americanbankingnews.com › 2022 › 01 › 08 › deutsche-bank-ag-has-23-91-million-position-in-vanguard-high-dividend-yield-etf-nysearcavym.html DeutscheBank AG lowered its stake in Vanguard High Dividend Yield ETF (NYSEARCA:VYM) by 25.5% in the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 231,307 shares of the company’s stock after selling 78,972 shares during the period. DeutscheBank AG […]

Deutsche Bank AG Has $23.98 Million Stake in Vanguard …

https://www.americanbankingnews.com › 2022 › 01 › 08 › deutsche-bank-ag-has-23-98-million-stake-in-vanguard-mortgage-backed-securities-index-fund-etf-shares-nasdaqvmbs.html DeutscheBank AG increased its stake in shares of Vanguard Mortgage-Backed Securities Index Fund ETF Shares (NASDAQ:VMBS) by 15.7% during the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 450,000 shares of the exchange traded fund’s stock after acquiring an additional 61,100 shares […]

https://www.reuters.com/article/us-ubs-group-lawsuit-idUSKCN1ND10F

Top JPMorgan Chase Shareholders – Investopedia

https://www.investopedia.com › articles › insights › 052416 › top-5-jp-morgan-shareholders-jpm.asp Vanguard Group Inc. Vanguard Group owns 244.9 million shares of JPMorganChase, representing 8.0% of total shares outstanding, according to the company’s 13F filing for the period ending March 31 …

Who Owns JPMorgan Chase? | The Motley Fool

https://www.fool.com › investing › general › 2013 › 02 › 19 › who-owns-jpmorgan-chase.aspx As you can see in the following chart, the majority of JPMorgan’s nearly 3.8 billion shares are held by institutional investors. Company insiders, including board members and corporate executives …

RESEARCH TEAM

Please take Notice that the Cause Birchfield VS Deutsche Bank, JP Morgan Chase, Gerald Cugno / Preimier Mortgage Funding, Select Portfolio Services Et Al …. Will be Appealed to the US Supreme Court.

The THEFT of the Two Defaults perpetrated by US District JUDGE ROBERT LEON JORDAN and the 6th Circuit Court of Appeals is yet another example of Judicial Tyranny and Fraud By The Courts of the United States Inc.

Cugno’s and Premier’s Defaults should forever be memorialized as the Epitomy of Judicial Abuse in the Chronicles of the Predatory Foreclosures MONEY LAUNDERING Debacle of US and Foreign Banks.

Premier, Paramount and Pioneer Mortgage Funding of Gerald Cugno and Vast Money Laundering with Mortgages is no longer in dispute ….

Cugno and Premier Mortgage Funding DEFAULTED.

Research Team

Jacqueline Birchfield

CC … Judson Witham

12 MILLION Secreted SARS Reports WHAT Treasury FBI and DOJ are HIDING

Good old Vanguard and JP Morgan Chase and Deutsche Bank / AIG ….. Yup Vanguard and AIG as well …..

BlackRock and Vanguard: The Same Shady People Own Big …

https://noqreport.com › 2021 › 06 › 15 › blackrock-and-vanguard-the-same-shady-people-own-big-pharma-and-the-media BlackRock/Vanguard Own the Media. When it comes to The New York Times, as of May 2021, BlackRock is the second-largest stockholder at 7.43% of total shares, just after The Vanguard Group, which owns the largest portion (8.11%). 13,14. In addition to The New York Times, Vanguard and BlackRock are also the top two owners of Time Warner, Comcast …

| Inbox | x |

| SwampFox <notjuris@gmail.com> | 1:00 PM (0 minutes ago) |   | |

to Tips, dschwartz, tips, tips, tips, Kim, Stephen, FRC, bmonroe, Financial, trey.gowdy, Richard.Holmes, michael.sallah, tanya.kozvrevah, azeen.ghorayshi |

Lets get the other 12 Million SARS reports Out in the PUBLIC INFORMATION ARENA

HUD FHA OCFPB OCC Treasury FBI and DOJ need to explain the CHURNING of the Predatory Foreclosures and how Laundered Trillions are the enabling / funding mechanism for MILLIONS of Subprime Predatory FORECLOSURES that are being CHURNED

12 Million SECRET SARS reports far far exceed the 2,100 Buzzfeed and Daily Beast, ICIJ has released. 2,100 is a mere 0.02 % of the Secreted 12 Million CHURNING FORECLOSURES -CHURNING FORECLOSURES – https://www.bing.com/search…… See More

BING.COM CHURNING FORECLOSURES – Bing

Laundering Money funding US Mortgages thats a Big Big Big NO NO …..The Skinny: The U.S. Treasury’s Financial Crimes Enforcement Network (FinCEN), the country’s financial intelligence unit (FIU), has issued a statement about several impending news reports about a breach related to its anti-money laundering (AML) filing database. The arbiter of financial crime co… ACFCS.ORG In cryptic statement, FinCEN warns of leak, theft tied to SAR database, but whether a drip or a deluge, answer coming soon –

The Big Four that Rule the World: State Street, Vanguard …

https://twistedeconomix.wordpress.com › 2014 › 10 › 24 › the-big-four-that-rule-the-world-state-street-vanguard-blackrock-and-fidelityIn short: the eight largest U.S. financial companies (JPMorgan, Wells Fargo, Bank of America, Citigroup, Goldman Sachs, U.S. Bancorp, Bank of New York Mellon and Morgan Stanley) are 100% controlled by ten shareholders and we have four companies always present in all decisions: BlackRock, State Street, Vanguard and Fidelity.

https://www.google.com/search?q=money+laundering+subprime+mortgages+foreclosures+judson+witham

LETS GET SOME HISTORICAL PERSPECTIVE SHALL WE

TRILLIONS LOOTED and We WHINE Over Pelosi Tearing Up Papers LOL Puhleaze

Land scams out the ASS https://www.bing.com/search?q=bank+looting+land+swindle+mortgage+fraud

https://www.bing.com/search?q=Land%20Swindles%2084%20Captures%20&qs=ds&form=QBRE

The REAL ACCOUNTS of Looting and Laundering Trillions in America

DEAR US JUSTICE DEPARTMENT FBI FinCen CFPB HUD FHA Take Notes

PREDATORY LAUNDERING The Actual Facts

Since first reading Beware of the Ranchero Racketeers a Readers Digest Series by Paul Friggins in 1966 , I have followed the implementation of DIRT DEALING, Land Scheming and Real Estate CONS as a very lucrative form of Fraud and a Major Money Laundering Vehicle for TRILLIONS.

This is the Grand Story of Realty Frauds known across America as RICO REALITY …. Looting, Churning and Laundering the BILLIONS

Enjoy the Ride …. J.B. Witham

Money laundering is the processing of these criminal proceeds to disguise their illegal origin. … Illegal arms sales, smuggling, and the activities of organised crime, including for example drug trafficking and prostitution rings, can generate huge amounts of proceeds.Money Laundering – Financial Action Task Force (FATF)

https://www.fatf-gafi.org › faq › moneylaundering

HOW TRILLIONS HAVE BEEN STOLEN AND LAUNDERED THROUGH REALTY CRIMES AND PREDATORY MORTGAGES

625 Billion + FOIA DEMAND ….. 15 Million Sketchy Loans ….. THE ACTUAL WHISTLE BLOWER …. CHURNING THE LAUNDRY

| Inbox | x |

| SwampFox <notjuris@gmail.com> | 12:49 PM (0 minutes ago) |   | |

to FSCDems, FRC, Esq., FinCEN, Jacqueline, bravenewfilms, georgia, Gerry, Sarah, Sarah, Kim, andrew, CFLA, CFPB_FOIA, foia, FOIA, FOIA-PA |

TRILLIONS LOOTED THROUGH PREDATORY MORTGAGES AND TRILLIONS MORE STOLEN WITH PREDATORY FORECLOSURES

625 Billion + as many as 15 Million SKETCHY Mortgages

Gee Golly Whiz BURN THE HOUSE DOWN …… Imagine That Yeah BURN WITHAM’s House Down

• Mark Zandi, Chief Economist for Moody’s Economy.com, calculates that the fallout from 15 million “sketchy” loans made between mid-2004 and mid-2007 will cost the U.S. financial system $625 billion. As staggering as these figures are, they are still likely to be low because mortgage fraud didn’t stop in mid-2007 when the financial markets collapsed. It got worse and, after a slight lull in 2008, fraud risk indicators appear to be poised for a rebound in 2009 and beyond:56

On Fri, Feb 7, 2020 at 12:36 PM SwampFox <notjuris@gmail.com> wrote:

It seems that 15 Millions Sketchy Loans associated with JUDSON WITHAM’s Whistle Blowing reveals 15 Million SKETCHY LOANS are in addition to the Vast Realty SCAMS exposed by Judson Witham during the 1980s and 1990s and early on in the 2000s ….. IT SEEMS JUDSON WITHAM DAMNED CERTAINLY WAS RIGHT

15 Million Sketchy Loans

CFPB and HUD FHA ….. Exactly what Audit , Abstract, Forensics PROCESS and TECHNIQUES are employed to determine the Legitimacy of these 15 Million Sketchy Loans ???

How do HUD/FHA and the CFPB and DOJ and FBI how are the SKETCHY LOANS examined for FRAUD ??Files and Records that reveal HOW these Mortgages are assessed for Lawfulness and Fraud is demanded per FOIL.

( What are the investigation techniques employed to review the 15 Million Sketchy Mortgages ) Judson Witham notjuris@gmail.com

On Tue, Feb 4, 2020 at 8:45 AM SwampFox <notjuris@gmail.com> wrote:

The Continuing Friggen Story

DEAR US JUSTICE DEPARTMENT FBI FinCen CFPB HUD FHA Take Notes Foreign and Domestic Banksters PARKING MONEY in Predatory Realty Deals …. Predatory Foreclosures THE SECRET ART OF THE GREAT AMER…LAYMANSLAW.HOME.BLOGHow to Steal and Launder Trillions in American ForeclosuresDEAR US JUSTICE DEPARTMENT FBI FinCen CFPB HUD FHA Take Notes Foreign and Domestic Banksters PARKING MONEY in Predatory Realty Deals …. Predatory Foreclosures THE SECRET ART OF THE GREAT AMER…

Laundering Money Parking Money and the Predatory Foreclosure ( and churning )

THE BIG SLEAZY …. TRUMP’s PALS https://youtu.be/df0VkcgljtA

YOUTUBE.COM MAFIA DON’s BIG FRAUDS

Lets look at His FINANCIERS THE MONEY LAUNDERING PIGS https://www.bing.com/search?q=deutsche%20bank%20fraud%20laundering%20criminal&qs=ds&form=QBRE

https://www.youtube.com/watch?v=Wb_zYYCgpLE&t=10s

DEAR US JUSTICE DEPARTMENT FBI FinCen CFPB HUD FHA Take Notes

How to Steal and Launder Trillions in Predatory Foreclosures

www.lexology.com › library › detail

How is money laundered through real estate? – Lexology

May 14, 2018 – The laundering of illicit funds through real estate is an established money laundering method in Australia. Criminals may be drawn to money …

People also ask

How money laundering works in real estate?

How can I legally launder money?

How Shell companies are used for money laundering?

What is money laundering example?

Feedback

Web results

business.financialpost.com › pmn › business-pmn › why-criminals-look-…

Why criminals look to Canada to launder their money through … May 10, 2019 – International money launderers typically leave the properties vacant, driving up real estate prices and hollowing out neighbourhoods, said Garry Clement, former national director of the RCMP’s Proceeds of Crime Program. … “Most of it’s for parking money.”

www.corporatecomplianceinsights.com › Compliance

Money Laundering Schemes in Real Estate | Corporate …

Feb 17, 2016 – real estate still a key avenue for money laundering … Parking the property meaning: to buy a property and keep it for some time, then sell it with …

www.curbed.com › money-laundering-real-estate-paul-manafort-trial

Why financial criminals use real estate to launder money …

Aug 10, 2018 – Manafort is accused of laundering money he made while advising a pro-Russian regime in Ukraine by buying and renovating properties in the …

parkingtheweek.com › articles › how-foreign-investors-launder-money-new-…

How foreign investors launder their money in New York real …

Nov 13, 2017 – How foreign investors launder their money in New York real estate … 70th Streets between Fifth and Park are vacant at least 10 months a year.

www.cresinsurance.com › money-laundering-in-real-estate

Money Laundering in the Real Estate Industry

Mar 7, 2018 – Real estate money laundering is not a new problem in the United States. According to the Financial Action Task Force on Money Laundering …

parkingwww.stout.com › insights › article › how-shell-companies-facilitate-m…

How Shell Companies Facilitate Money Laundering in Luxury …

Nov 10, 2017 – A spike in high-end residential real estate prices and associated … U.S. is not a go-to safe haven for parking gains from corruption, drug trafficking, … risks of money laundering associated with certain real estate transactions.

www.cnbc.com › 2017/08/24 › a-third-of-luxe-real-estate-deals-invol…

Government expands crackdown on money laundering in real …

Aug 24, 2017 – Government expands crackdown on money laundering in real estate … a lot of foreign buyers were parking their money in high-end real estate …

www.washingtonexaminer.com › money-laundering-is-shaping-us-cities

Money laundering is shaping US cities – Washington Examiner

Mar 27, 2017 – In Manhattan, the blocks between Lenox Hill and Central Park, between … For real estate money laundering, however, requiring reports from …

betterdwelling.com › how-a-little-money-laundering-can-have-a-big-i…

How A Little Money Laundering Can Have A Big Impact On Real

Apr 24, 2019 – Money laundering in Canadian real estate is a widely accepted fact of … Parking cash long term in assets is not typical – these aren’t investors.

THE ORIGINAL WHISTLE BLOWER SPEAKS

CHURNING THE LAUNDERED Way Way Way BEYOND The Panama Papers

Money Laundering Schemes in Real Estate | Corporate …

- How Big of A Problem Is This in The Real Estate sector?

- How Does The Ill-Gotten Money Seep Into The Real Estate sector?

- Conclusion

The Global Illicit Financial Flows Report estimates that China, Russia and India are the top three countries receiving ill-gotten money moving out of the U.S. Chinese nationals are on the top of foreign buyers of the Australian real estate, with nearly $6 billion in 2013. Indians and Russians are among the largest non-Arab investors of real estate in Dubai. Between 2012 to 2014, Indians only invested more than 44 billion dirhams in the Dubai r…See more on corporatecomplianceinsights.com

1MDB | Park Lane Hotel | Money Laundering Real Estate

https://therealdeal.com/issues_articles/nycs-dirty-money-files

NYC’s dirty money files. Behind the money–laundering web ensnaring developers and making Manhattan real estate a ground zero for shady cash

Government expands crackdown on money laundering in real …

https://www.cnbc.com/2017/08/24/a-third-of-luxe-real-estate-deals-involve-suspicious…

Aug 24, 2017 · Government expands crackdown on money laundering in real estate. … If a lot of foreign buyers were parking their money in high-end real estate and that much of it is tainted, this rule will have …

How A Little Money Laundering Can Have A Big Impact On …

https://betterdwelling.com/how-a-little-money-laundering-can-have-a-big-impact-on-real…

Apr 24, 2019 · Money laundering in Canadian real estate is a widely accepted fact of life these days, but the impact isn’t. Government and academics are still debating how much money is needed to distort a market. The truth is, not a whole lot is required to distort any …

Money Laundering in the Real Estate Industry

Mar 07, 2018 · Real estate money laundering is not a new problem in the United States. According to the Financial Action Task Force on Money Laundering (FATF), the real estate industry is particularly vulnerable. The US Department of Treasury’s Financial Crimes Enforcement Network (FinCEN) agrees. Various programs and crackdowns aimed at identifying the …

- Reviews: 1

- Author: Amanda Strong

How To Launder Drug Money: Start An LLC And Buy Real Estate

https://www.mintpressnews.com/how-to-launder-drug-money-start-an-llc-and-buy-real…

How To Launder Drug Money: Start An LLC And Buy Real Estate An explosion in cash-only home sales reveals a possible loophole in laws designed to prevent money laundering.

Why financial criminals use real estate to launder money …

https://www.curbed.com/2018/8/10/17674584/money…

Aug 10, 2018 · One of the primary advantages of laundering money through real estate is that you can move a lot of money in one transaction, particularly if you’re …

How money laundering works in real estate – The Washington …

https://www.washingtonpost.com/news/politics/wp/…

Jan 04, 2018 · He walked us through how money laundering works in the real–estate industry and how others may be implicated in that criminal activity. “With any money laundering, you’re trying to make the …

How foreign investors launder their money in New York real …

https://www.theweek.com/…/how-foreign-investors-launder-money-new-york-real-estate

Nov 13, 2017 · The alleged money laundering scheme of Paul Manafort — President Trump’s former campaign chairman who was recently indicted — involved New York real estate.

Money Laundering – Definition, Examples, Meaning, and Cases

https://legaldictionary.net/money-laundering

Money laundering: the act of disguising the source or true nature of money obtained through illegal means. … parking buildings or lots, and other businesses with low variable costs. Shell companies and trusts are used to disguise the true owner or agent of a large amount of money. … Real estate laundering occurs when someone purchases real …

The Racketeer Influenced and Corrupt Organizations Act, commonly referred to as the RICO Act or simply RICO, is a United States federal law that provides for extended criminal …… Create a book · Download as PDF · Printable version … is a registered trademark of the Wikimedia Foundation, Inc., a non-profit organization.

It allows prosecution and civil penalties for racketeering activity performed as part of an ongoing criminal enterprise. Such activity may include illegal gambling, bribery, kidnapping, murder, money laundering, counterfeiting, embezzlement, drug trafficking, slavery, and a host of other unsavory business practices.

What Is Racketeering? – Investopedia

https://www.investopedia.com › … › Laws & Regulations › Crime & Frau

Jul 28, 2019 – The U.S. government introduced the Racketeer Influenced and Corrupt Organizations Act in October 1970 to contain racketeering. Through RICO, prosecutors can charge a person if they have committed at least two acts of racketeering within a 10-year period.

Dec 7, 2017 – In a criminal RICO case, the racketeering activities must be shown to be related. … Penalties for RICO convictions are substantial and include imprisonment, criminal forfeiture, plus fines as high as twice the gross profits or proceeds of the RICO offense.

Credit Suisse Accused in Multimillion Dollar Fraud, $15 …

https://www.occrp.org/en/daily/5087-credit-suisse-accused-in-multimillion-dollar-fraud…

Mar 25, 2016 · In an unrelated case, Credit Suisse also faces a criminal probe in Italy for money laundering. Italian judicial sources told Reuters the bank is being investigated for allegedly helping wealthy clients transfer undeclared funds offshore.

Credit Suisse Is Urged to Improve Money-Laundering …

https://www.bloomberg.com/news/articles/2018-09-17/credit-suisse-ordered-to-boost…

Sep 17, 2018 · Credit Suisse Group AG was given until the end of next year to strengthen its internal processes to combat money laundering as Switzerland’s financial regulator concluded a …

- Photographer: Matthew Lloyd/Bloomberg

- Author: Jan-Henrik Foerster

Credit Suisse Probed over Alleged Money Laundering

https://www.finews.com/news/english-news/37141-credit-suisse-swiss-attorney-general…

Credit Suisse is ensnared in a Swiss criminal probe into alleged money laundering involving a criminal organization and the illegal drug trade. The Swiss attorney general has named the investigation «Bulco»: prosecutors are investigating alleged money laundering by a criminal organization, weekly «Schweiz am Wochenende» (in German) reported. The wider probe, which began in 2008, centers on an alleged drug …

Tidjane Thiam The Credit Suisse ‘Spy’ Committed Suicide …

https://financearmageddon.blogspot.com/2019/09/tidjane-thiam-credit-suisse-spy.html

Tidjane Thiam The Credit Suisse ‘Spy‘ Committed Suicide !! The Credit Suisse Group AG spying scandal that has rocked Swiss financial circles took a new turn on Monday , with the the Credit Suisse contractor ,Tidjane Thiam , who hired private detectives to follow a former top executive , …

Credit Suisse ensnared in tax evasion and money laundering …

https://www.scmp.com/business/companies/article/…

Apr 01, 2017 · Swiss bank Credit Suisse has been dragged into yet more tax evasion and money laundering investigations, after a tip-off to Dutch prosecutors about tens of thousands of suspect accounts triggered …

- Author: Reuters

Credit Suisse boss resigns following UBS spying scandal …

https://www.thelocal.ch/20191001/credit-suisse…

4 hours ago · Credit Suisse said Tuesday that a top executive had resigned after assuming responsibility for the bank’s decision to spy on a star banker after he jumped ship to competitor UBS. The Swiss banking giant said that its chief operating officer Pierre-Olivier Bouee had stepped down following an internal investigation into the spying …

Credit Suisse COO resigns over spying scandal – SWI …

https://www.swissinfo.ch/eng/business/banking…

10 hours ago · Reuse article Credit Suisse COO resigns over spying scandal Oct 1, 2019 – 07:55 Credit Suisse Group Chief Operating Officer Pierre-Olivier Bouee has resigned following a spying scandal that has…

Credit Suisse Tabloid Scandal Explodes Into Threat to CEO …

https://www.bloomberg.com/news/articles/2019-09-25/credit-suisse-spy-probe-is-set-to…

Sep 25, 2019 · Credit Suisse Star Khan’s Thwarted Ambition Led to Rift With CEO. What’s not in dispute is the relationship between Khan and Thiam had soured in the months before his exit in July.

Credit Suisse Probe Homes In on Operating Chief – SWI …

https://www.swissinfo.ch/eng/bloomberg/credit-suisse-probe-homes-in-on-operating-chief/…

3 days ago · (Bloomberg) — Credit Suisse Group AG’s probe into a botched spying operation is homing in on the role of Chief Operating Officer Pierre-Olivier Bouee, according to a person familiar with the …

THE ORIGINAL WHISTLE BLOWERWEB.ARCHIVE.ORG Restoring The Bill of Rights One Website at a Time (May 26, 2000) I believe that very shortly I will be setup AGAIN on more Red Herring FALSE Charges by Local and Probably Federal…

Rigging and Controlling EVERYTHING with FIAT CRAP MONEY since 1917 …. the Helicopter QE Mafia

Oh Look Many MONTHS after We Blew the Whistle in Bankruptcy and US District Court in Tennessee About this website CBSNEWS.COM How the Danske Bank money-laundering scheme involving $230 billion unraveled It could be the biggest money-laundering scheme in history, with suspicious money flowing from Russia and former Soviet republics

Note the level of Corruption in the DOJ and FBI

See Operation Lone Star a Flood of Guns and Blood YOUTUBE.COM Judge Jeanine: Now we know why Hillary used private email She did it for the oldest of motives: greed

DIRT DEALING TRICKS You always wanted to know BUT

The Object of the Racketeering is to transform the DIRTY MONEY into a Clean Real Estate Asset ( The Predatory Foreclosure )

The conversion or transfer of property, the concealment or disguising of the nature of the proceeds, the acquisition, possession or use of property, knowing that these are derived from criminal activity and participate or assist the movement of funds to make the proceeds appear legitimate, is money laundering.

Loaning Money to HIGH RISK BORROWERS for Realty and Homes simply allows the Money Launderers to PARK the funds until the High Risk Borrower defaults. The Predatory Foreclosure allows the Paper Contract Credits to be converted to HARD REALTY ASSETS , The Magic of Money Laundering JBW ( Research Team )

DIRTY MONEY TO CLEAN REAL ESTATE ASSETS

were to afraid to ASK

The FIAT SCRIP AT THE VERY HEART OF THE PREDATORY FORECLOSURES

| SwampFox | 10:17 AM (1 minute ago) | ||

| to FSCDemsPress, bpold.frankfurt, cam, FRC, AskDOJ, FSCDems, Esq., Donald, Jacqueline |

What is truly amazing is the VAST Money Laundering of the Biggest Dirtiest Banks employs PREDATORY SUBPRIME FORECLOSURE. https://laymanslaw.home.blog/how-to-steal-and-launder-trillions-in-american-foreclosures/

Succinctly stated the UNLAWFUL Mortgage Practices use the FILTHY MONEY being Laundered.

The cause and effect of all this TAINTED FUNDING renders the Mortgages VOID as the enabling funds are themselves CRIMINAL and Civilly Fraudulent in their origins AKA Racketeering Money.https://laymanslaw.home.blog/how-to-steal-and-launder-trillions-in-american-foreclosures/

There are VAST NUMBERS of Unlawfully obtained Mortgage Contracts directly linked to enormous CRIMINAL ACTIVITIES

So Yes FinCen FBI DOJ HUD FHFA FHLBB the WHISTLE IS BLOWNhttps://laymanslaw.home.blog/2019/06/28/deutsche-bank-the-mortgages-and-the-laundry/

Judson WithamResearch TeamThe Whistle Blowers

ILLEGAL MONEY FUNDING PREDATORY MORTGAGES MAKES THE MORTGAGES THE PRODUCT OF RACKETEERING

See Cause 2:19-CV-005 US District Court Greeneville Tennessee, Magistrate Clifton L. Corker ALREADY RULED

https://laymanslaw.home.blog/2019/06/28/deutsche-bank-the-mortgages-and-the-laundry/

Jacqueline BirchfieldJudson Witham

https://laymanslaw.home.blog/how-to-steal-and-launder-trillions-in-american-foreclosures/

WELCOME TO THE GREAT AMERICAN LAUNDRY

Churning

Churning is the process of making multiple transfers of funds in order to make the analysis of bank accounts by an investigator more difficult. When a person is engaged in money laundering, dirty money is initially recorded in a bank account. Once a sufficient amount of cash has been accumulated, it is broken up and wired to multiple other accounts, typically in foreign locations, where the amounts are again split up and wired to other bank accounts. This constant reshuffling process obscures the origin of the cash.

The churning concept can also apply to the excessive buying and selling of client-owned securities by a broker in order to earn commissions. This situation can only arise when a broker has discretionary authority over a client’s account.

How to Launder Billions with Subprime Predatory Foreclosures

The NEVER ENDING STORY of Smurfs and Predatory Foreclosures predicated to WASH THE FILTHY LUCRE’

THE FORECLOSURES ( The Realty Etc. ) ARE THE LAUNDERED ASSETS

FinCEN has issued numerous studies analyzing SARs reporting suspected mortgage fraud and money laundering that involved both banks and residential mortgage lenders and originators. The reports underscore the potential benefits of AML and SAR regulations for a variety of businesses in the primary and secondary residential mortgage markets. Residential mortgage lenders and originators are primary providers of mortgage finance – in most cases dealing directly with the consumer – and are in a unique position to assess and identify money laundering risks and fraud. ( HAHAHA Self Reporting LOL ) Yeah Same as Narcotic Traffickers

“FinCEN offers a unique analytical perspective on mortgage fraud because of our position at the intersection of law enforcement and the financial industry. ( HA HA HA HA ) This perspective will help both constituencies assess the risks to the financial system from their points of view. From this special vantage point, FinCEN has a line of sight into suspicious financial activities across the nation to identify trends and patterns that may not be visible to an individual financial institution or industry, or apparent at the local or even regional level. While the Bank Secrecy Act is most often associated with its considerable power to thwart money launderers, FinCEN intends to continually improve our expert analysis of BSA data to provide early warning to the nation of incipient trends of fraud or other criminal abuse of the financial system.” SARS REPORTING HAHAHAHAHA

A SPECIAL MESSAGE FOR THE US TRUSTEES , DOJ and Especially FinCEN, HUD and FHA …. and ALL Their OIGs

The money-laundering arena. MOs are getting more sophisticated and concealed a little more carefully. Result: the development of anti-money laundering software that helps detect and deter money-laundering activities. Gone are the days of relentlessly reviewing report after report to no avail. Hit ‘run query” and all sorts of goodies pop up. Thankfully, technology has kept pace with the schemers.

AML (Anti-Money Laundering) and BSA (Bank Secrecy Act) laws are absolutely my favorite regulations. No other regulation can provide the feeling of accomplishment when money-laundering violations are found and reported. The same goes for anti-terrorist funding reports. You feel you made a difference that is valued by law enforcement and government. However, no matter what your business line is, money laundering can influence your bottom line. That said, here is a brief overview on how and what should happen when detecting and deterring money-laundering

First, there are two definitions for money laundering:

- It is the introduction of illegally obtained currency into the banking system, AND

- It is using the banking system to illegally hide currency that was lawfully obtained.

Then there are the three general methods of money laundering:

Placement – the process of depositing illegal assets into the financial industry through ANY method: wires, cash, checks, money orders, etc.

Layering – the movement of illegal assets through financial institutions to separate the assets from the origin illegal source: wire transfers, CDs, drafts, letters of credit, internal transfers, negotiable instruments, foreign exchange, ACH, etc.

Integration – the movement of “laundered” funds back into the economy as legitimate funds (wire transfers, ACH, checks, Internet, etc.)

Suspicious Activity – Defined

It is impossible to define all activity that would qualify as suspicious. However, the following guidelines quantify the types of suspicious accounts/activities that should be monitored:

1. “High-risk” businesses (defined later in this article),

2. Other business with high wire transfer activity, particularly wires to foreign entities and banks,

3. Cash intensive businesses,

4. Frequent consumer foreign wire transfer activity,

5. Frequent large cash consumer deposits and withdrawals.

One of the best ways to avoid being an unknowing accomplice to money launderers is to properly identify new customers, clients and vendors.

General Procedures for Detecting Money Laundering

Accounts/activities falling into the category of “high risk” as defined by FinCEN (www.fincen.gov) or because of the individual account risk assessment process, should be reviewed for suspicious activity, money laundering and structured transactions. (Structuring is defined as making deposits and withdrawals in a series of transaction to avoid Currency Transaction Reporting requirements (http://www.fincen.gov/forms/files/fin104_ctr.pdf ). Structuring transactions is against the law, and a Suspicious Activity Report (Treasury form TDF 90-22.47) must be filed.

Detecting money laundering requires a several things. Use your technology. Review and analyze your data. Obtain supporting documentation. Retain all records relating to the case for at least 5 years. File a Suspicious Activity Report if warranted.

Certain types of business are more likely to be involved with money laundering. Examples of high-risk type accounts include but are not limited to Non-Bank Financial Institutions (NBFI’s), Professional Service Providers, Non-Governmental Agencies (non-profits) and cash intensive businesses. Accordingly, all businesses that are classified as one of the following may receive increased scrutiny of account activity. Mortgage Brokers, Real Estate Marketing and the Parking and Churning of Dirty Funds in the SUBPRIME MORTGAGE RACKETS.

This is not an all-inclusive list but rather samples of typical cash intensive, high-risk types of customers.

- Check cashing operations

- Currency dealer or exchanger

- Convenience stores

- Adult entertainment clubs

- Used car or motorcycle dealers that finance their own sales

- Used boat dealers that finance their own sales

- Liquor stores

- Apartment houses

- Restaurants

- Parking garages

- Car wash facilities

- Charitable organizations

- Jewelers

- Doctors

- Agent accounts for Money Service Businesses

- Money Service Businesses

- Other Professional Services (accountant, attorney, etc.)

- Privately owned ATMs and Leased ATMs

- Real Estate Development, Residential and Commercial Realty

- Subprime Mortgage and Foreclosure Scams

Suspicious and high-risk accounts should be monitored closely and should include site visits to determine the legitimacy of the business, business address and to determine if the business activity is consistent with the stated business activity, established at account opening.

Anti-Money Laundering & Suspicious Activities – Lending

Lending vehicles are becoming more and more popular with money launderers. Unusual or suspect actions, such as hesitancy to provide required identification, or refusal to provide the purpose for a loan, are key warning signs. Apparent unusual concern for secrecy regarding personal identity, occupation, type of business or property held. Other factors:

- Displays high level of curiosity about internal systems, policies, and controls.

- Has little knowledge of the amount and details of a transaction; provides confusing and/or inconsistent details about a transaction; or is unwilling to provide explanation about a transaction.

- Appears nervous, secretive, and reluctant to meet in person; over justifies or explains a transaction.

- Lifestyle inconsistent with known, legitimate sources of income or possesses large sums of money not consistent with known income sources.

- Use of multiple Post Office boxes or changes addresses frequently.

- Transactions with no logical economic purpose (no link between the activity of the organization or business and other parties involved in the transaction).

- Same day transactions at same depository institutions using different teller windows.

- Use of sequentially numbered money orders.

- Opening an account or loan where several persons have no apparent familial or business relationship but are designated signature authority.

- Individual is associated with a person linked to document forgery.

Simply Amazing Huh SENIOR BANKRUPTCY JUDGE MARCIA PHILLIPS

From A to Z how the Dirtiest Dirt Dealers LAUNDERING ALL THEIR BILLIONS

RAMPANT FRAUDULENT MORTGAGES FRAUDULENT FORECLOSURES

Comey and Mueller, Jeff Sessions, Loretta Lynch, Eric Holder, Alberto Gonzales, John Ashcroft, Louis Freeh, William Weld, Ed Meese, William Barr, Christopher Wrays FINGERPRINTS are everywhere, Bushs, Clintons, Credit Suisse, JP Morgan, Deutsche Bank, Bank of America, Gold in Sachs the VIRUS of Looted and Laundered Trillions is THE GREAT AMERICAN LAUNDRY

Since the Days of the Stories of Paul Friggins and Don Bolles comes an ONGOING SAGA …. The Great American Laundry …… The Never Ending Crime Spree of Dirt Dealing and Money Laundering ….. JBW

THE NEVER ENDING DIRT BAG DIRT DEALING STORY

TOXICZOMBIEDEVELOPMENTS.WORDPRESS.COM

Hey Mafia DON …. DEPORT YOUR CROOKED ASS BANKSTER PALS

HIS BANKSTERS NEED TO GO BACK TO GERMANY AND LEAVE ALL THE MONEY AND HOMES THEY STOLE HERE ….. TRUMP DEPORT YOUR CROOKED ASS BANKSTER PALS TOXICZOMBIEDEVELOPMENTS Home $2…

The Greatest Texas Bank Job / Felonious Colonias … Land …

https://toxiczombiedevelopments.wordpress.com/2015/07/02/the-greatest-texas-bank-job…

Mortgage Fraud Bank Looting Money Laundering Land Swindles …. Judson Witham; Non-Border Red Flag Wildcat Unrecorded Illegal Paper Ghost Toxic Zombie Colonias Subdivisions; ON NOTICE US Congress US Senate US DOJ; Predatory Foreclosures LIARS LOANS and the Laundering of Trillions

Beware of the “SUBPRIME” Gangster Bankster “TOXIC ZOMBIE …

https://lootednation.wordpress.com/…/beware-of-the-gangster-bankster–ranchero-racketeers

This compilation of SUBPRIME REAL ESTATE, TOXIC ZOMBIE, GANGSTER BANKSTER, TITLE COMPANY SWINDLES AND FRAUDS needs to be attached to and ALWAYS included in the NCIC and other Files on Myself and the GARGANTUAN Whistleblowing Efforts I have engaged in for more than 35 Years.

Predatory Foreclosures LIARS LOANS and the Laundering of …

https://toxiczombiedevelopments.wordpress.com/predatory–foreclosures-liars-loans-and…

Abracadabra Presto Change O JP Morgan Chase, The CUGNO MAFIA and Deutsche Bank HAVE NO CLOTHES A Message to the United States Justice Department, Attorney General William Barr and Christopher Wray ….. Using Predatory Subprime Foreclosures is at the HEART of all that Money Laundering as well as RIPPING OFF The USA Mortgage Programs ….

.

The Subprime Swindle And The Foreclosure Fraud Cover-Up …

https://ourfuture.org/20101012/The_Subprime_

The Subprime Swindle And The Foreclosure Fraud Cover-Up. by Zach Carter | Oct 12, 2010 … mortgage servicing costs may increase while the “track down” paperwork—they’re worried that the entire $2.6 trillionmortgage-backed security market is about to land on their doorstep, with punitive damages and prison sentences tacked on. …

Illegal Foreclosures are a Nullity – Home | Facebook

https://http://www.facebook.com/pages/Illegal-Foreclosures-are-a-Nullity/205419306331396

Illegal Foreclosures are a Nullity. 622 likes · 2 talking about this. Unlawful Foreclosures are Human and Civil Rights Crimes. Theft By Deception and…

Deutsche Bank THE Mortgages and the Laundry – Law for the …

https://laymanslaw.home.blog/2019/06/28/deutsche-bank-the-mortgages-and-the-laundry

Lie after Lie after Lie, Deception, Misleading, Hidden, Falsified, Forged, the Frauds began BEFORE the Beginning. A Message to the United States Justice Department, Attorney General William Barr and Christopher Wray …..Using Predatory Subprime Foreclosures is at the HEART of all that Money Laundering as well as RIPPING OFF The USA Mortgage Programs …..

Land Scamming Bank Looting America All the Minerals Gas …

https://lootednation.wordpress.com/land-scamming-bank-looting-america-all-the-minerals…

LOOTING TRILLIONS the Largest INSIDE JOB EVER BEWARE OF THE GANGSTER BANKSTERS …. The Continuing Friggin Story In Honor of Paul Friggins This Page is dedicated to the COUNTLESS Heroes that have been DRAINING THE SWAMP for many decades. The STAGGERING ROBBERIES must be STOPPED….. Swamp Fox FROM 1979 covering the 1976 Murder of

What actually Happened ( For the Complete Idiot …

https://americalooted.wordpress.com/what-happened-actually

Land equals the possibility of posterity. The reason Europe stagnated throughout history was because all the land was owned by Royalty and their cronies and the people were nothing more than servants allowed to eek out a bare subsistence with the owners of the land growing ever more wealthy on their backs.

Look THE Britain Defender flown by the CHICKEN SHIT CLUB

The FACTUAL NEWS WIKI-LEAKS and All The Others HAVE ALWAYS BEEN TO CHICKEN SHIT to actually address.

Yes That is Correct SEE THE CHICKEN SHIT CLUB

“What has replaced prosecuting individual executives…are these negotiated settlements… The corporation writes a check. And a piece of paper is put in a drawer… and the prosecutors say,

LISTEN IN TO A WONDERFUL BROADCAST ABOUT THE CHICKEN SHIT CLUB

‘Well, we could prosecute you, but we’re not going to for now. And we want to watch you to see if you behave yourself.’ My argument is that this has replaced the prosecutions of individuals, and that this fundamentally does not work. It is a regime that is broken. And the reason we know it doesn’t work is that we see… corporations breaking rules repeatedly and getting sanctioned and then breaking them again. JP Morgan, Pfizer, BP, these companies, many other companies are recidivists. They have broken rules and been accused of crimes and sometimes pled guilty to crimes – over and over again – and still commit wrongdoing. So, this is a regime that just does not work.” Jesse Eisinger, author of The Chicken Shit Club: Why the Justice Department Fails to Prosecute Executives.

| SwampFox <notjuris@gmail.com> | 11:49 AM (2 hours ago) | ||

| to ustrustee.program, AskDOJ, Esq., CFPB_FOIA, FinCEN, Jacqueline, james.haltom, Bobby, Civil.Feedback, ogis, Cc:, john.baxter, gwallach, FSCDems, James, paul, foreclosureinformation, cwaters, GAClosings, RIPORequests, evstatus, webmaster, ecfhelp, grvlclerk, knoxclerk, chatclerk, georgia, Gerry, Margaret, Marisa, billie, bcc: georgia, bcc: Gerry, bcc: billie, bcc: Esq., bcc: Sarah, bcc: Kim |

Dear William Barr , Christopher Wray, Judge Leon Jordan, Magistrate Clifton L. Corker, County Clerk Bobby Russell, Etc Et Al, case 2:19-CV-005 US District Court Greeneville, Tennessee

FRAUD VITIATES EVERYTHING IT TOUCHES …… Laundering Money with PREDATORY Mortgages and Foreclosures HOW IS IT PRECISELY TRILLIONS DO GET LAUNDERED …. Lets SeeWELL LETS SEE HOW THE CIA and all Their DIRT BAG PALS did it in the 1960s, 1970s, 1980s and 1990s

Using Predatory Real Estate Schemes to get DIRTY MONEY out of Europe / Outta Russia / Outta the USA to Launder VAST Narcotics, Human Trafficking , Terrorists Capital using the RUN OF THE MILL Scams of folks like the CUGNO MAFIA and all of CUGNO’s Mortgage Brokers and Realty GANGS THAT operate across America involves MANY SLIGHTS OF HAND.

It should be noted that the NAZI BANKSTERS and JP Morgan Chase with CUGNO and the Credit Swiss / PMI / Select Portfolio Services CABAL have been caught 100s of thousands of times PERPETRATING LIES by the MILLIONS. You see folks STEALING Trillions with Realty Scams and then ATTEMPTING to Launder the Properties to the GOOD OL GIRLS and GOOD OL BOYS in America ….. Well THAT DOG JUST WON’T HUNT.

As William Barr and Christopher Wray KNOW ….. The TRACK RECORD of Judson Witham ( Research Team ) began long ago in UP STATE NEW YORK …. Playground to the MOBS. Oh and Ya’ll remember that BANKING and S&L / Real Estate Fiasco of the 1970s and 80s ….. You know IRAN CONTRA and CHARLIE WILSON’s WAR staged from UPTOWN HOUSTON at the Clinton / Bush HOUSTONIAN ESTATES Bunker there North of Lamar Terrace where the TRIAD MAFIA were running SECRET WARS like what the Hillary Clinton / Blow Job Bill Syndicate went on to pull in Libya and Syria. LOL You know WIPE THE SERVERS CLEAN and HEAVY ON THE BLEACH BIT. Well in this case 2:19-CV-005 Birchfield / Research Team THE WHISTLEBLOWERS demand that a FULL Forensics Inspection of all those 125% Nothing Down – NO CREDIT VERIFICATION – Liars Loans all over Tennessee and BEYOND that are the very HEART of the Abracadabra and HOCUS POCUS AMERICAN LAUNDRY be FULLY AUDITED and THOROUGHLY INVESTIGATED

For the RECORD …. Being from the ADIRONDACKS and Kicking the BANKSTERS and Their DIRT DEALERS in the SCROTUMS in Texas comes with a certain level of AWARENESS.You See DEAN O COUCH and the King of Arizona along with Charlie Ponzi used OFF THE RACK TRICKS and never really were all that good at it.

RESEARCH TEAM / WHISTLE BLOWERS understand very well PREDATORY FORECLOSURES and TONS of Unsophisticated Marks, You know PIGEONS ….. Wannabe Homeowners were SETUP to allow the LOOTING and LAUNDERING to work. Simply stated when You steal TRILLIONS …. Yah Have to Have a SCHEME ” right outta the starting blocks “. Feel free to ask Hillary Clinton and Blow Job Bill and yes especially make cretain You ask George Bush Jr. and the BUSH MOBSTERS. One point to make is very simple ….. DONALD J. TRUMP knows plenty about the good ol TRIAD MOB and Their Work with that ENTERPRISING MAFIA the COMPANY and the BOIZ. YOU KNOW ….. The Stand Alone Off The Shelf SYNDICATE N COMPANY …. THE DARK MONEY CABAL

▶ 5:52:41 Jul 14, 1987Lt. Colonel Oliver North’s last day of testimony. … off-the-shelf,independent, stand–alone, self-sustaining …

Good Ol Ollie and COMPANY ….. Hocus Pocus Right.Laundering Money with Industrial Development and what Savings and Loans / Mortgage Banks

Using PREDATORY Foreclosures to CLEAN THE DIRTY MONEY ….. Not All That Bright FELLASRemember now Joseph Ferrone and Saul Balmouth and the FAMILIES were amazing at hiding the FAMILIES Money in UPSTATE NEW YORK

- The TRIAD and Martin Harris’s Hat … SEER This Joe Smith …https://americalooted.wordpress.com/the-triad-and-martin–harriss–hat-seer-this-the…The TRIAD and Martin Harris’s Hat … SEER This Joe Smith … The Mormon MAFIA and the Deep State; The Underbelly of Mortgage Fraud Cons; The VANISHED Trillions – The Largest Heist in Human History; TRILLIONS Up In Smoke …. Exposed’ TRILLIONS for FUBAR; TRUMP OBAMA CLINTON BUSH and the Vanishing Trillions

- Rigging the SWAMP …. EXPOSING The Company USA Inc Has NO …https://toxiczombiedevelopments.wordpress.com/rigging-the-swamp-exposing-the-company...The TRIAD and Martin Harris’s Hat … SEER This Joe Smith … The Mormon MAFIA and the Deep State. ATTENTION US Secret Service, FBI, DOJ and All My Friends … Harris and Montgomery County … The HEART OF THE BEAST … Clinton Bush and COMPANY. Former US Secret Service Agent RICK WILLIAMS ….. Conoco Phillips Oil WOODLANDS TEXAS …

- HOUSTON TEXAS / Black Ops Central ….. Tell’em TREY GOWDY

- You see when You spend 40 Years around UPSTATE NEW YORK and the WITH THE DODGE BOYS in Texas, Utah, Arkansas, Florida and Tennessee YOU UNDERSTAND THE HOCUS POCUS behind THE GREAT AMERICAN LAUNDRY

- YES FOLKS

- THE GREAT AMERICAN LAUNDRY

- Compliments of THE RESEARCH TEAM

- Earth Looted By The Money Changers – The Missing …https://theadirondacksconspiracy.wordpress.com/earth-Oct 29, 1999 · Toxic Zombie Land Swindles Bank Frauds – Bing Bing is a search engine that brings together the best of search and people in your social networks to …

- What actually Happened ( For the Complete Idiot …https://americalooted.wordpress.com/what-happened-actuallyLand Flipping and Dirt Dealing 101 CLINTONIAN LAND SCAMMING The Dirt Dealing Guru’s Hand Book; Land Scamming Texas Arizona Florida Saudi Arabia Arizona New Jersey California UTAH Style LETS TALK CLINTONIAN DIRT DEALING … The TOXIC ZOMBIE LAND SWINDLES … Land Swindles, Bank Looting … 3 Responses to Looted Nation ….. The Sleeping Masses …

- Beware of the “SUBPRIME” Gangster Bankster “TOXIC ZOMBIE …https://lootednation.wordpress.com/…/beware-of-the-gangster-bankster–ranchero-racketeersSep 28, 2016 · Toxic Zombie Land Swindles Bank Frauds … ← Dirt Dealing America … LootingTrillions 101 Adirondacks Lake George SAND HARVESTING The Hudson River → 2 thoughts on “ Beware of the “SUBPRIME” Gangster Bankster “TOXIC ZOMBIE” Ranchero Racketeers ”

- DRAIN THE SWAMP – BLACK OPS R US | The Adirondacks …https://theadirondacksconspiracy.wordpress.com/drain-the-swamp-black-ops-r-usThe VANISHING of Trillions DNC / RNC American Style YOUTUBE.COM Looting and Laundering TRILLIONS DNC & RNC Style The USA Inc. has LOTS to explain THE OVAL OFFICE has lots to ANSWER TO . FINANCING THE SWAMP … AMERICA SOLD DOWN THE RIVER Imagine That Sheriff Guy Williams , Judge Barb Sadler THE VERY SAME …

- Beware of the Toxic Zombie Dirt Dealers the Bankster …https://americalooted.wordpress.com/2018/01/28/beware-of-the-toxic-zombie–dirt–dealers…Dec 31, 1997 · Land Flipping and Dirt Dealing 101 CLINTONIAN LAND SCAMMING The Dirt DealingGuru’s Hand Book; Land Scamming Texas Arizona Florida Saudi Arabia Arizona New Jersey California UTAH Style LETS TALK CLINTONIAN DIRT DEALING; Land Speculation Paper Land Swindles on STEROIDS; Land Swindles: A Cons Game to Beware Of

- The Subprime Swindle And The Foreclosure Fraud Cover-Up …https://ourfuture.org/20101012/The_Subprime_Oct 12, 2010 · The Subprime Swindle And The Foreclosure Fraud Cover-Up. by Zach Carter | Oct 12, 2010 … Clearly, we’re dealing with a lot of different frauds here. Tomorrow, I’ll detail one of the smaller-bore problems with foreclosure fraud: providing cover for illegal fees that lenders charge to troubled borrowers. … If you’re a bank that packages …

- The Greatest Texas Bank Job / Felonious Colonias … Land …https://toxiczombiedevelopments.wordpress.com/2015/07/02/the-greatest-texas-bank-job…Jul 02, 2015 · Mortgage Fraud Bank Looting Money Laundering Land Swindles …. Judson Witham … The Greatest Texas Bank Job / Felonious Colonias … Land Frauds Texas Style. July 2, 2015 June 28, 2019 withament. Predatory Mortgages Predatory Foreclosures … The DIRT DEALING SCAMS OF …

- Looted Stupid the missing American TRILLIONS on Vimeohttps://vimeo.com/162428493

26:20Apr 11, 2016 · Bank Swindles and Dirt Dealing Land Speculation 101 CLINTONIAN STYLE BANK ROBBING ….. The TAYLOR BEAN AND WHITACKER METHOD ….. Beware of the Ranchero Racketeers and the Dirt Dealing …

- The GREAT TEXAS Land Swindles Savings and Loans Banks …https://toxiczombiedevelopments.wordpress.com/the-great-texas-land–swindles-savings…Conroe and Houston Texas the Great CESSPOOL Of Land Swindles and Frauds. … GRIFFIN ABSTRACT FIRE across from the Montgomery County Court House and ROY HARRIS’s little Money Machine and the WHOLE LAND CON S&L, Bank Looting Mess all leads to JOHN McCones Western Bank…

- Looted Stupid – America’s Greatest Robbery of ALL TIME …https://lootednation.wordpress.com/looted-stupid-americas-greatest-robbery-of-all-timeLand Scamming Bank Looting America All the Minerals Gas and Oil and Credit Papers To ….. America Looted Stupid Looted Stupid – America’s Greatest Robbery of ALL TIME

- Illegal Foreclosures are a Nullity – Home | Facebookhttps://www.facebook.com/Illegal-Foreclosures-are-a-Nullity-205419306331396bank looting land swindles trillions stolen – Bing. Intelligent search from Bing makes it easier to quickly find what you’re looking for and rewards you. See All.

- The Subprime Swindle And The Foreclosure Fraud Cover-Up …https://ourfuture.org/20101012/The_Subprime_Oct 12, 2010 · The Subprime Swindle And The Foreclosure Fraud Cover-Up. by Zach Carter | Oct 12, 2010 … Clearly, we’re dealing with a lot of different frauds here. Tomorrow, I’ll detail one of the smaller-bore problems with foreclosure fraud: providing cover for illegal fees that lenders charge to troubled borrowers. … If you’re a bank that packages …

- Wipe the Servers Shred the Records ERASE … – facebook.comhttps://www.facebook.com/Wipe-the-Servers-Shred-the-Records-ERASE-The-Truth…trillions looted toxic zombie land swindles – Bing Intelligent search from Bing makes it easier to quickly find what you’re looking for and rewards you. Wipe the Servers Shred the Records ERASE The Truth

- IOLANI – The Royal Hawk: Whistleblower website and linkshttps://iolani-theroyalhawk.blogspot.com/2018/06/whistleblower-website-and-links.htmlJun 24, 2018 · Land Speculation Paper Land Swindles on STEROIDS; Land Swindles: A Cons Game to Beware Of; Looting the World the Easy RICO Realty Way; LOTS OF INDICTMENTS … Land & BankScams 101; New York State a very Shitty Record; Planetary Looting an INSIDE JOB …

- The Financial Crisis Initiative | Justice Leaguehttps://justiceleaguetaskforce.wordpress.com/2016/04/28/the-financial-crisis-initiativeApr 28, 2016 · This week, three of the Bank Whistleblowers United founders, joined me in Dallas, to be on the McCuistion Television program specifically addressing our BWU initiative, what really caused the financial crisis and what must be done now to prevent another. The TV taping went very well and I’ll be sharing the program itself with you in a future post.…

- [CTRL] [2] The Great Texas Bank Job – The Mail Archivehttps://www.mail-archive.com/ctrl@listserv.aol.com/msg44641.htmlJun 16, 2000 · [CTRL] [2] The Great Texas Bank Job. Kris Millegan Fri, 16 Jun 2000 08:25:41 … How About it Ms. Reno is your answer LAND FRAUD ? … WAKE UP, who do you think you’re fooling ? “More Giant Sucking Sounds” Ross Perot 11/26/97 Just Like the American Bank System Looting you are being LIED TO and SENT the BILL again The Greenspan, William Seidman …

- Deutsche Bank THE Mortgages and the Laundry – Law for the …https://laymanslaw.home.blog/2019/06/28/deutsche-bank-the-mortgages-and-the-laundryJun 28, 2019 · Lie after Lie after Lie, Deception, Misleading, Hidden, Falsified, Forged, the Frauds began BEFORE the Beginning. A Message to the United States Justice Department, Attorney General William Barr and Christopher Wray …..Using Predatory Subprime Foreclosures is at the HEART of all that Money Laundering as well as RIPPING OFF The USA Mortgage Programs …..

- The Monster: How a Gang of Predatory Lenders and Bankers …https://www.alternet.org/story/148577/the_monster:_how_a_gang_of_predatory_lenders_and…Oct 21, 2010 · The following is an excerpt from Michael Hudson’s THE MONSTER: How a Gang of Predatory Lenders and Wall Street Bankers Fleeced America – And Spawned a Global Crisis (2010, Times Books). A few …

- WILLIAM F. MARSHALL – THE DIRTY DEALS AND SHADY DEALINGS…https://mexicanoccupation.blogspot.com/2017/06/william-f-marshall-dirty-deals-and.htmlJun 29, 2017 · WILLIAM F. MARSHALL – THE DIRTY DEALS AND SHADY DEALINGS OF JANE AND BERNIE SANDERS – TYPICAL CORRUPT POLITICIANS … Burlington College didn’t realize the bounty President Jane had promised from her land deal inspiration. … the now-defunct Burlington took out a bank loan to make the deal, but that required a minimum commitment of $2.27 …

- IOLANI – The Royal Hawk: Judson Witham: On the Watchhttps://iolani-theroyalhawk.blogspot.com/2018/06/judson-witham-on-watch.htmlINVERTED TOTALITARIANISM (“a corporate monstrosity rules us”): “Inverted totalitarianism is different from classical forms of totalitarianism. It does not find … its expression in a demagogue or charismatic leader but in the faceless anonymity of the corporate state. Our inverted totalitarianism pays outward fealty to the facade of electoral politics, the Constitution, civil liberties …

- Wiki-Freaks Connect the Dots – Posts | Facebookhttps://www.prod.facebook.com/Wiki-Freaks-Connect-the-Dots-1188867971169769/postsWiki-Freaks Connect the Dots. 121 likes. The real INTERESTING Facts involve the FOREIGN MONEY behind Bill and Hillary AND the Bushs and…

SEE ESPECIALLY

Re: [CTRL] [CIA-DRUGS] Restoring The Bill of Rights One Website at a Time JURISNOT

David: The site that the email was copied from is here: http://www.geocities.com/jurisnot/ Jokes: What is the difference between Colombian Drug Cartels and the Justice Departments?Answer: One deals drugs. and the other laws http://www.qui-tam.com/ Specific RICO Violations http

[CTRL] [1] The Great Texas Bank Job

from: http://www.geocities.com/jurisnot/ Click Here: A HREF=”http://www.geocities.com/jurisnot/”The Great Texas Bank Job/A – Restoring The Bill of Rights One Website at a Time The Great Texas Bank Job Campaign Finance Corruption, Colonias Land Fraud, the Texas Judicial MAFIA and a

[CTRL] [2] The Great Texas Bank Job

from: http://www.geocities.com/jurisnot/ Click Here: A HREF=”http://www.geocities.com/jurisnot/”The Great Texas Bank Job/A – “Soft Money Boys?” Yeah, uh huh !! I have a Unrecorded Colonias Subdivision to sell you too ! The Justice Department, FBI, FDIC, RTC, Con

Date Posted:22:21:55 12/05/07 Wed

Author:Judson Witham

Subject:

CROOKED DEVELOPERS & BANKING COLLAPSE

Date: Wed, 5 Dec 2007 18:53:11 -0800 (PST)

From: “judson witham”

Subject: Crooked Developers & Banking Collapse

To: Hapa1234@aol.com

CC: “Bobby Harmon” , “David Farmer” , “Michael Dowling” , “James Cribley” , “Lawrence Goya” , “Pension Benefit Guaranty Association” , “Robert Bruce Graham” , “Nathan Aipa” , “Michael Mukasey” , “Curtis Ching” , “Steven Guttman” , “Hugh Jones” , “Linda Lingle” , “James B Nicholson” , “Excutive Office for U.S. Trustees” , “David A. Ezra” , “Kevin S.C. Chang” , “Barry M. Kurren” , “Sue Beitia” , “Office of Inspector General US Dept of Justice” , “Colbert Matsumoto” , “George Will” , “Ruth Ann Becker” , “Hawaii Chapter Nature Conservancy” , “Haunani Apoliona” , “Michael Marsh” , “Leroy Colombe”

Some of the subdivisions have plats recorded with the county as required by state law. Others – about 600 – are unrecorded or “red flag” subdivisions that do not meet county road and drainage standards and have no plats, or plans, filed.

Crooked Developers & Banking Collapse

Paper: HOUSTON CHRONICLE

Date: MON 06/22/1987

Section: 1

Page: 10

Edition: 2 STAR

Resident’s crusading `fans fire’/Subdivision’s critic outlines difficulties

By CATHY GORDON, Staff

Kneeling beside a large pothole, Pinewood Village resident Judson Witham recites statutes from the state property code as if they were treasured passages from a favorite poem.

“I about know them by heart,” Witham proclaims, measuring the pothole’s depth with a fallen twig. “I’ve made it my duty. I want to warn people about the Pinewood Villages of the world.”

Around the Montgomery County courthouse, Witham’s name is synonymous with the problem-plagued subdivision he lives in.

It started six years ago with his myriad of complaints to developers and county officials about the unrecorded east county subdivision’s drainage and roads.

Five years later, the 30-year-old disabled construction worker who refers to Pinewood Village as “The Tiger Mosquito Ranch” was sitting in a jail cell, accused of threatening to kill Vice President George Bush and an assistant Montgomery County attorney over his subdivision woes.

“It was character assassination,” bellowed Witham, who claims he never threatened to kill Bush or the assistant Montgomery County attorney, Marc Winberry.

“I got angry at Mr. Winberry. Very, very angry. But I don’t think I threatened to kill him. I said something like `This just got personal and I’d like to rip your head off your shoulders.”‘ Witham said Winberry laughed at him during the telephone conversation, a claim the attorney denies.

“The last thing I wanted to do was do anything to contribute to his highly agitated state,” Winberry said.

Prosecutors said they dropped the third-degree felony charge of retaliation on condition that Witham “go forth and sin no more.”

As for the allegation that he threatened Bush, Witham said he was nervous and angry when he called Houston’s FBI office at 3 a.m. one night in November 1985 after his family was harassed by unknown motorists in a jeep.

“I started telling the FBI person about the problems out here and said if the vice president was being unfairly subjected to what my family and others in this county have been subjected to in Pinewood Village, they’d be all over it. They misunderstood me. I asked `What would you do if I threatened to kill the vice president of the United States?’ Next thing I know, they’re coming to get me.”

The federal charge against Witham was also dropped on condition that he undergo mental analysis.

Witham says he underwent a mental evaluation at Houston’s St. Joseph’s Hospital. “They wanted to see what made me tick. The psychiatric evaluation showed that all areas of my life were in normal parameters, except for the situation with Pinewood Village.”

Witham said he invested $50,000 building a two-story home on land that cost him $27,000. “It’s appraised at zero,” he said. “I couldn’t sell this subtropical swamp if I wanted to.”

He has lawsuits against the subdivision’s former financier, Western Bank on Westheimer; one against the county, its commissioners and county attorney; and another against American Title Insurance Co. whose licensed agent, the now defunct Eagle Title Co., issued title opinions on the land.

Witham accuses the county of turning its head from developers who skirted county subdivision regulations, a claim that has put him at odds with several Montgomery County office holders.

“Montgomery County has had years to enforce those regulations, but the good old boys sat back in their boots and straw hats and said `OK, let’s be easy on this one. He’s a good old boy like the rest of us,”‘ Witham claimed. “I’ve done what I’ve had to to get my point across.”

During a 1986 session of Commissioners Court, Witham plopped a jar of water in front of commissioners, challenging them to a “not so refreshing drink fresh from a Pinewood Village tap.”

He exhibits pictures of potholes in Pinewood Village, their widths and lengths duly noted.

“He definitely fans the fire. He keeps it going day and night,” said the subdivision’s developer Donald Clesson. He added that he doesn’t always appreciate the manner in which Witham draws attention to the subdivision.

County officials agree.

“I feel sorry for his situation, but he goes about things the wrong way. He wants to blame everything on the county and that’s not where the fault lies,” said a county official, who requested anonymity.

Counters Witham: “I’ve had a hell of an education and made my mistakes. But my only motivation is putting a stop to Pinewood Villages. I don’t think it’s right for anyone to be defrauded, especially in the purchase of a family home. That’s the sanctity of the family. It’s like people stealing candy from babies.”

Paper: HOUSTON CHRONICLE

Date: SUN 06/21/1987

Section: 1

Page: 1

Edition: 2 STAR

POTHOLES & PROMISES/Montgomery County’s crumbling subdivisions/ Homeowners handle property woes

By CATHY GORDON, Staff

Polish immigrant Steve Szladewski’s ruddy complexion grows redder as he rattles off the sales pitch that led him to buy property in the Shepard’s Landing subdivision in Montgomery County.

Former astronaut Alan Shepard, the subdivision’s developer with former Houston Mayor Louie Welch, was to be his next-door neighbor, a salesman bragged. Szladewski’s land, though bordering the San Jacinto River, was unlikely to flood. And the horseshoe-shaped road winding through the subdivision would be paved.

“Alan Shepard didn’t move next door. A guy from New Jersey bought that lot,” said Szladewski, a small, gray-bearded man who struggles with his English.

The road also failed to materialize, and on one occasion, Szladewski anchored his tiny clapboard house to two large oak trees to save it from being swept away by the rain-swollen river.

“In Poland, I learn people in America help each other. But in America, I learn sometimes they say things so you buy.”

Szladewski is not alone. Shepard’s Landing, developed in Montgomery County’s real estate boom of the late 1960s through early 1980s, is one of hundreds of problem-plagued subdivisions that have come back to haunt the county and its residents during the bust.

They are speckled throughout the county’s dense pine forests, the legacy of a ripe economy gone sour. In many instances, they are the handiwork of unscrupulous developers who skirted the county’s rules to make a fast buck.

Some developers, however, say the county is to blame for encouraging development without spelling out or enforcing any restrictions.

Some of the subdivisions have plats recorded with the county as required by state law. Others – about 600 – are unrecorded or “red flag” subdivisions that do not meet county road and drainage standards and have no plats, or plans, filed.

All of them hold disgruntled, heartbroken homeowners with similar stories:

When Mike and Pam Jordan purchased five acres of land in The Wilderness subdivision off FM 1488 for $21,000, they were told there would be no problem in getting basic services such as electricity to their wooded lot.